Condo buying guide

Start with these:

1. Hire a professional realtor to help you. No cost for you , seller pays the commission.

2. Find a good lawyer.

3. Find ( some bank or landing institutions)where you can approve a mortgage, to determine how much mortgage you can afford.

4. Don’t forget about this- You’ll need extra money for closing costs, moving, land transfer tax and lawyers’ fees.

Looking for apartment:

5. Bear in mind that a southern exposure, although bright and sunny, may also be hot in the summer.

6. Avoid a layout that looks out over the garbage pick-up area.

7. Choose a handsome view. Not only will it make day-to-day life more appealing, but it helps withresale later.

8. A parking space is highly recommended. Even if you don’t drive, you can always rent it out.

9. Be prepared to see a variety of styles: low-rise, high-rise, with or without amenities such as doormen or gym facilities.

10. Avoid a suite beside or across from the elevator.

11. Buy the largest apartment you can afford. Studios and one-bedrooms are more difficult to re-sell.

12. Avoid a suite that overlooks the garage entrance and the coming and going of vehicle traffic.

13. Visit the neighbourhood at different times of the day and evening. Does it suit you?

From www.thecondolife.com/buyers_tips.html

Condo buying guide

Eight Tips for First-Time Buyers:

1. Be Realistic. It’s important to remember that there is no perfect condo; therefore, be selective but reasonable when looking for your new condo.

2. Do Your Research. Decide what you need in a condo with our Needs Versus Wants Assessment then use our handy Your Condo Wish List worksheet to prioritize these things before you start looking. This crucial step will save you time and money.

3. Get Your Finances in Order. Review your credit report and be sure you have enough money to cover your down payment and your closing costs. Also, be sure you don’t have too much credit. Lenders often consider how much credit you have available. Being maxed out on your credit is a sure way of getting turned down for a mortgage. It’s a good idea to postpone big purchases until after you’ve bought your condo. Try to pay off or pay down as much of your credit as possible prior to applying for a loan.

4. Don’t Wait to Get a Loan. Talk to a lender and get pre-approved for a mortgage before you start looking. You’ll save time during the closing by starting this process beforehand. Plus, you’ll know how much you can borrow.

5. Choose the Right Mortgage. Investigate all your options. Be sure to consider initial interest rates as well as future ones and any possible prepayment penalties.

6. Find Out When You Can Move. When is your lease up? Are you allowed to sublet?

7. Think Long-Term. Are you looking for a starter condo with the idea of moving up in a few years or do you hope to stay in this condo longer? Think about your long-term goals before searching for a new condo.

8. Don’t Let Yourself Get “House Poor.” If you max yourself out to buy the most expensive condo you can afford, you’ll have no money left for maintenance, decoration or to save money for other financial goals.

For additional mistakes to avoid as a first-time buyer, read the accompanying article, “Seven Costly Financing Mistakes Most First-Time Buyers Make and How to Avoid Them.”

Condo buying guide

Toronto condos news

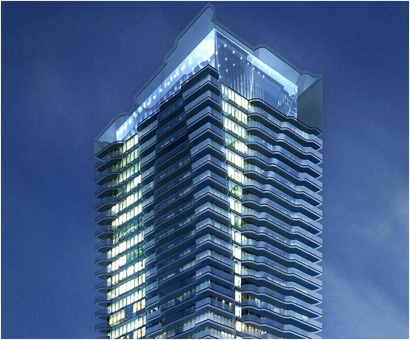

One Bloor street Toronto condos

Great Gulf’s flagship condominium, One Bloor is under construction in Toronto. This $450 million project will provide 100,000 sq. ft. of new prime retail on three levels, and add 732 new residential suites

http://onebloor.com/

Toronto new luxury condo The Four Seasons Private Residences